Discover a Better Way to Engage Investors and Build Liquidity

We Teach Small Caps How to Create Efficient Outreach Campaigns That Deliver Measurable Results.

Discover Your Story

Build a System

Scale with Confidence

Small Caps are fighting an uphill battle

Liquidity constraints limit growth, undervalue innovation, and strain financial flexibility. Traditional strategies like press releases, roadshows, and PR often yield no measurable results.

Without addressing these challenges, companies risk being undervalued, missing critical funding opportunities, and losing credibility in the market.

Your Guide to Liquidity Success

Liquidity Coach specializes in helping small-cap companies systematically grow their shareholder base, improve liquidity, and lower the cost of capital. With our proven Shareholder Acquisition System, you’ll attract and engage the right investors to unlock your company’s full potential.

What We Offer

- Workshops: Learn the fundamentals while you build

- Coaching: Personalized Guidance and Support

- Full-Service: Built and managed for you campaigns*

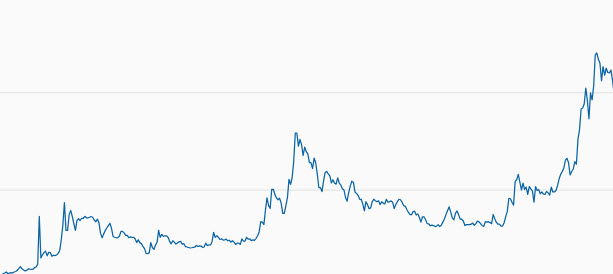

From This

(Client Chart from 2019-2020 Prior to engagement)

To This

(Client Chart from 2020-2021 After engagement)

"The Right Data Turns Liquidity from a Challenge Into an Advantage."

Bill Kaitz

Small-cap companies often outperform their larger peers, yet they struggle to capture the market attention they deserve. Many strategies promise results—press releases, roadshows, even flashy PR campaigns—but few deliver measurable, lasting impact.

Over the past 20 years, I’ve learned one thing: liquidity isn’t just a market metric; it’s the foundation for growth. The challenge isn’t knowing that liquidity matters—it’s understanding where it comes from and how to sustain it.

I’ve spent the last 15 years refining the Shareholder Acquisition System, a method that helps small-cap companies focus on what truly drives liquidity: measurable investor engagement. This system isn’t about guesswork; it’s about using data to guide every decision. With limited budgets and high stakes, precision is everything.

Through this approach, clients have seen real results (on average):

A 4,000% increase in trading volume.

A 5x boost in net cash from financings.

A 115% rise in market cap.

More importantly, they’ve transformed their IR budgets from a cost center into a high-yield investment—one that attracts not just shareholders but the relationships that lead to lasting market success.

For years, I managed these efforts through a referral-only agency, guiding select companies with millions in budgets. Now, I’ve turned my focus to teaching and coaching because I believe every small-cap company deserves a chance to thrive.

I’m here to guide you, step by step, as you build a scalable system for liquidity. Together, we’ll ensure your efforts resonate with the right investors, cut wasted spending, and unlock your company’s true potential in the market.

It’s time to stop competing for recognition and start commanding it.

How Does it Work?

Three Simple Steps to Capital Markets Confidence

Discover Your Investor Story

Craft compelling narratives that resonate with retail investors.

Build Your Shareholder Acquisition System

Use proven frameworks and checklists to seamlessly build your own system to grow liqudity.

Measure, Optimize, and Scale

Track every step with data-backed KPIs, ensuring your efforts yield maximum ROI.

Solutions Tailored for Size

Training Workshops

Learn the Frameworks to Build Liquidity on Your Own.

Master the Shareholder Acquisition System (SAS) and gain the tools to cut waste, amplify your IR reach, and drive measurable results—all in just three days.

Perfect For: Small caps ready to take control of their liquidity strategy.

Liquidity Coaching

Work With an Expert to Build Your Liquidity System.

Get personalized coaching and tech support to design and implement a liquidity strategy that works. Track your progress with a customized data dashboard and bi-weekly sessions.

Perfect For: IR teams needing guidance or facing accelerated growth timelines.

Liquidity Advantage

Let Us Handle Your Liquidity Strategy and Execution.

We’ll manage your liquidity efforts from start to finish, including content creation, media buying, and stakeholder alignment—all with milestone-based accountability.

Perfect For: Small caps with tight timelines ready to invest in measurable growth.

Find the Right Fit for Your Company’s Goals.

Whether you’re learning the system, implementing it with guidance, or handing it off to experts, Liquidity Coach is here to help.

Take Control of Your Liquidity Today

What Others Have to Say

4,000%

5X

13

Why Most Small Caps Struggle With Liquidity—and How You Can Fix It.

Transform your IR efforts into measurable, scalable growth with a proven system.

Small-cap companies often feel overshadowed, competing for attention with half the resources of larger players. Despite making up half the market and often outperforming their peers, small caps face an uphill battle for recognition. Traditional approaches, designed for mega caps with massive budgets, simply don’t work for smaller companies.

You need a modern solution for a modern challenge: a system that doesn’t just drain your budget but delivers measurable ROI and scales with your growth.

Unlock the 7 Strategies Driving Liquidity Growth for Small-Cap Companies

Discover how to build an IR program that creates sustainable trading volume, attracts retail investors, and positions your company for long-term success.