Stock Performance You Can Be Proud Of

Take the guesswork out of liquidity and have confidence in your IR budget with the Shareholder Acquisition System

Increased Liquidity

Better Capital Terms

Budget Confidence

Small Caps have to compete for the same coverage with half the budget of their larger peers.

It’s no wonder that large and mega cap companies receive 4X the amount of analyst coverage despite small caps outperforming these stocks.

If you are competing against well-funded companies using the same tactics you are likely experiencing one or all of the following:

Undervalued

Trading for a fraction of your true value?

Overlooked

Talking to many of the right people, but they aren’t taking action?

Costly Capital

Term sheets that are confusing or catastrophic?

When it comes to competing for capital, analyst coverage or large investment, liquidity is the linchpin to success for all Small Cap stocks. However, there are too many options and no guarantee of success when it comes to service providers and outdated PR efforts. Without a system to measure efficacy a wrong decision could spell disaster for your company and shareholders. I can show you how to avoid costly decisions and take control of your company’s liquidity.

Take the guesswork out of liquidity and have confidence in your IR budget with the Shareholder Acquisition System.

Take the guesswork out of liquidity and have confidence in your IR budget with the Shareholder Acquisition System.

Liquidity Gives Small Caps a "Blank Check" Status

Stock Performance You Can Be Proud Of

Stop being burdened by being public…

…and leverage your market for growth.

…and leverage your market for growth.

- Consistent System to Reach New Investors

- Get chased by analysts rather than the other way around

- Leverage your market not be burdened by it

- Raise more money, at better terms

- IR Budget as an ROI generator, not an expense

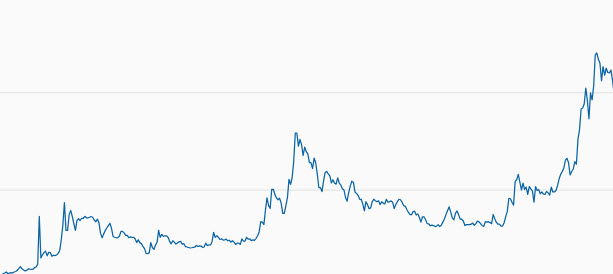

From This

To This

All small caps need is the right data driving their decisions to not only survive but thrive in the markets.

Bill Kaitz – Liquidity Coach

Small cap companies face the challenge of being overshadowed by their larger counterparts, despite consistently outperforming them.

While many strategies exist to compete for coverage and attract large investors, over the past 20 years, I’ve found that only one approach consistently delivers results: liquidity.The true challenge with liquidity isn’t recognizing its importance—it’s identifying its source.

After trying everything from IR to PR, from email to direct mail, I’ve spent the last 15 years focused solely on building sustainable liquidity for small cap companies across various sectors. The key lies in measuring what matters. With limited budgets, success hinges on a precise approach. My Shareholder Acquisition System provides the data and insights to track shareholder acquisition, optimize budget, and drive growth.

Recent clients have seen remarkable results, including a 4,000% increase in trading volume, a 5X boost in net cash from financings, and a 115% rise in market cap. Most importantly these clients have shifted their view of their IR budget from an expense to a high-yield investment.

For 12 years I have run a referral-only agency, managing hundreds of millions in budgets for a select few companies, now my calling has been to move on to teaching and coaching because I believe that every innovative small cap deserves authentic market recognition.

I’m here to guide you in leveraging digital marketing to fuel your liquidity, build a scalable system, and cut wasted expenses allowing you to execute. Together, we’ll pave the way for your company to thrive and attract the relationships that help lead you to blue-chip success.

Three Simple Steps to Capital Markets Confidence

How Does It Work?

Step 1

Schedule your free Strategy Session

Use the button below to book your free strategy session

Step 2

Receive your customized plan

Get a fully customized plan and understand exactly how to find your best long term investors while maximizing your budget

Step 3

Scale your IR efforts with confidence

Cut wasted expenses, and start growing liquidity and recognition confidently using leading indicators with your own Shareholder Acquisition System.

Solutions Tailored for Size

No two companies are alike, there are no cookie cutter solutions.

Training Workshop

I teach you how

- Live Zoom Workshop

- Learn the complete SAS

- Frameworks and Templates included

- Media buying "how to" and trusted source directory

- Samples and Swipe Files

- Discounted Media Buying assistance for all previous attendees

Liquidity Coaching

I help you along the way

- 6 Month Contract (cancel anytime)

- One on One Training Sessions

- Bi-Weekly coaching sessions

- Liquidity Coach tech team access.

- Data Dashboard set up and maintenance.

- Further Discounted Media Buying assistance.

Liquidity Advantage

I build and manage it for you

- Full Content and Web Development done for you

- Milestone based team and budget managment

- Personal oversight and coordination of all IR efforts

- Zero commission media buying assistance

- Management and Board presentations.

- Service by application only.

Learn Which Solution Is Right for Your Needs

What Others Have to Say

Don’t just take my word for it

4,000%

increase in trading volume*

5X

boost to Net Cash from Financings*

13

average contract renewals*

Over the last seven years, our companies have retained Bill Kaitz and his team to help us get our messaging to the public marketplace. In a competitive market where we face competition from a host of other companies vying for the same investor engagement, we have found Bill and his team to be effective, cost conscious and above all, experts in their industry. Our ability to attract the attention of the marketplace wouldn’t be the same without the support of their group.

Andrew Bowering

I have been in business over 25 years and I have never met anyone who pays attention to detail, provides expert service with such high integrity as William "Bill" Kaitz. It is an honor to work with him.

Dr. Michael N Brette, J.D. Small Cap Equity Advisors

Bill is one of the most intelligent digital marketers I’ve ever worked with. His understanding of marketing and sales funnels is only surpassed by the results that he delivers. As a mentor in his field, I have had every digital marketer on my team call Bill for guidance and insight and he graciously obliges. If you’re considering a digital marketer to work with, you’ve arrived at your decision.

Caleb Huey

Bill is one of the smartest guys I have worked with and a great, enjoyable person to work with. While working with Bill I always felt empowered to do my best work. This is a huge asset to have in someone you work with and is a rare quality not many in the business possess. Not only did I learn a great deal in working with him, I also knew he would always be up front and honest with me and ensure I was taken care of. It was truly a pleasure to work with him and I look forward to continuing to do business with him in the future.

Charles Marco

Previous

Next

*past results are not a promise of future performance

Gain the market you deserve through the data you need.

Small caps deserve reliable capital markets solutions.

Small caps need a reliable system that grows their market. Considering these companies have half the budget of large and mega caps it’s no wonder bigger players get 4X the coverage even though small public companies make up half the market (and typically outperform). Small caps won’t win using the same tactics with half the budget, what is needed is a modern solution to a modern problem, a system that yields ROI data and can consistently scale as these companies grow.

7 Hidden Costs that are Killing Your IR Program

The most common and problematic places and practices are that could be draining you dry and killing your chances at growing your valuations.